Skewness: the fallacy of the expected return

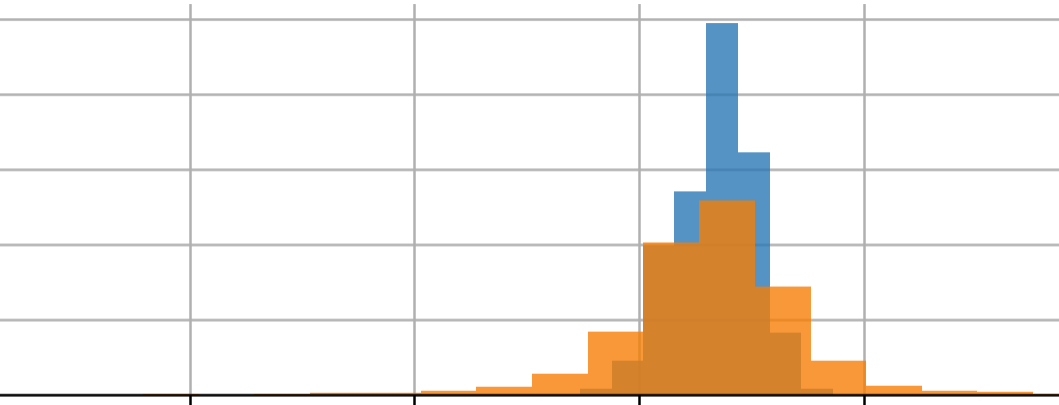

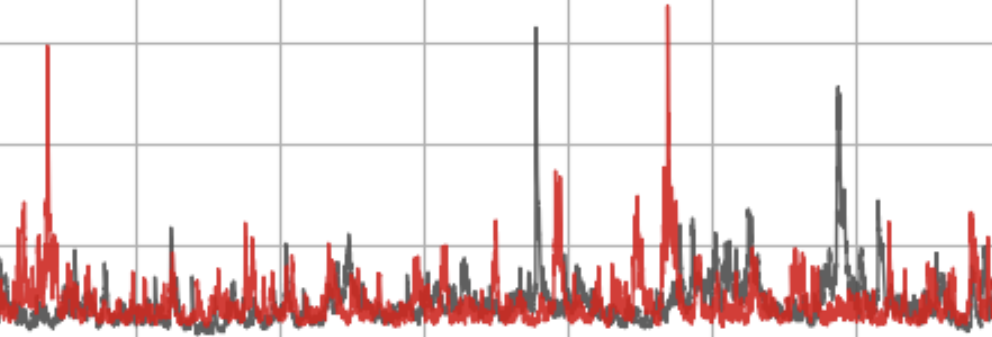

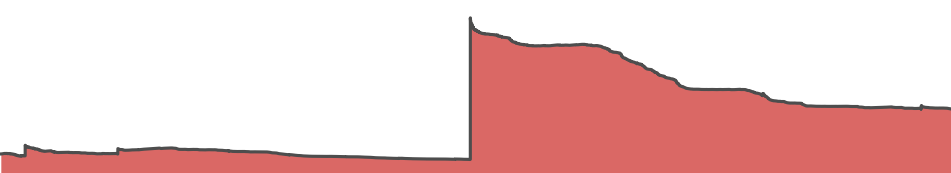

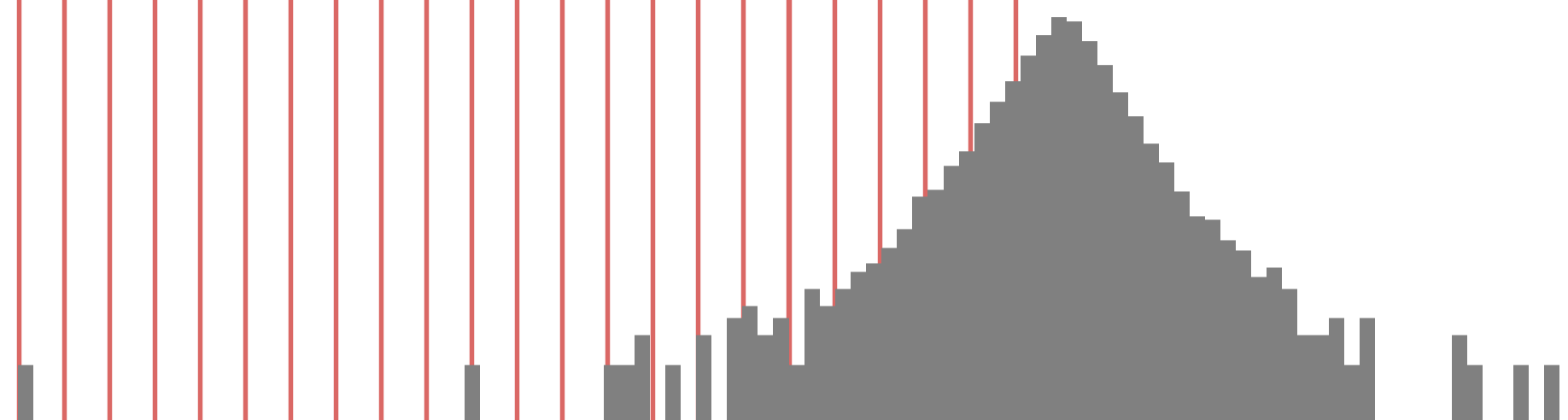

In this post we will take a closer look at the expected return that is often stated for investments like stocks and other financial assets, or for certain outcomes in gambling. The point we want to convey is that the expected return is only valid for one period or a single “iteration” (say, one year, … Read more